So, you’ve decided you want to open your own business in Japan! While there are a number of ways to achieve this, the easiest and quickest path is as a sole proprietor. However, like many things in Japan, the road to sole proprietorship is lined with language barriers and technical subtleties that can slow your progress.

To ease the stress and allow you to get on with your passion, we’ve created a comprehensive and easy-to-follow guide outlining the steps you’ll need to take on your journey to sole proprietorship in Japan. Expat entrepreneurs, read on!

What is a Sole Proprietor?

A sole proprietor is the simplest form of a business. You’ll own and be responsible for the business in its entirety, allowing you to start laying down the groundwork for success.

In Japanese, a sole proprietorship is referred to as a 個人事業 (kojin jigyo) which translates as ‘personal business.’ It differs from a 会社 (kaisha) company or 法人 (hojin) corporate body, which acts as its own entity separate from the people behind it.

Who Can Start a Sole Proprietorship in Japan?

Even if you have a great idea, not just anybody can set up a sole proprietorship in Japan. If your nationality is not Japanese, you’ll need one of the following:

- Spouse of Japanese National visa

- Long Term Resident visa

- Permanent Resident visa

- Spouse of Permanent Resident visa

- Working Holiday visa (with no restrictions)

- Dependent, Student, or Cultural Activities visa with permission to engage in other activities (you will need to apply for this permission separately)

- Engineer/Specialist in Humanities visa (must be sponsored by a Japanese company that approves of you working on the side)

- Skilled Labor visa (must be sponsored by a Japanese company that approves of you working on the side)

If you possess one of the above, you’re good to go!

Advantages of a Sole Proprietorship

Sole proprietorships are for those with dreams of working for themselves, being their own boss, and nurturing a successful business that may one day become a company or corporation. While continuing as a freelancer, gig worker, or contractor may be more suitable for most, if you’ve got a big idea, strong business plan, and marketable skill, setting up a sole proprietorship is a great way to show and grow it! The most common professionals who start up sole proprietorships include small restaurant owners, teachers, exporters, translators, writers, designers, and consultants. Other advantages include:

- Complete control and ownership of your business

- The potential to grow a brand

- Control of your income and work hours

- The ability to make deductions and claims (including rent for those working at home)

- The ability to hire people

- Potential visa self-sponsorship

- Simpler taxes (than a company or corporation)

Of course, not everything about a sole proprietorship is beneficial. While many of these are the same whether you start a business or continue as a freelancer, there are some potential disadvantages:

- Unstable income

- No company health insurance or pension

- Having to file your own taxes and keep track of finances

- Total liability – owner is personally responsible for everything, including bankruptcy.

- No shared ownerships or partnerships

Why Not Start a Company Instead?

There are numerous advantages to starting a company (法人), including the ability to bring in partners, generate greater profits without as much tax, and receive investments and funding. However, for those starting alone with a small idea, it’s much less stress and pressure to begin as a sole proprietor. Companies require accountants, overwhelming amounts of complex paperwork, dealing with national pension and health insurance, start-up costs, and other headaches.

Many who started successful companies in foreign countries had insider contacts or partners who assisted with certain tasks. If you have ambition, business knowledge, solid Japanese, funds, or trusted partners with the same, go for it! Otherwise, you might want to keep the idea of starting a company as a future goal after you’ve firmly established your sole proprietorship. Once the income from your sole proprietorship exceeds around 7 million yen a year, you’ll want to consider starting a company for tax benefits.

Requirements For A Sole Proprietorship

Apart from visa type, there aren’t too many requirements for a sole proprietorship in Japan. You’ll need a business name, which can be your own or an alias; a valid address in Japan, which can be residential; a bank account, and a telephone number (mobile is OK). Next, you’ll need to file an application with the Trade Register in Japan, which can be completed online or sent via the post office (see below for a full walkthrough). Depending upon the business itself, several more documents may be necessary, such as a permit from the Ministry of Education to open a language school, which is not covered in this article.

How to Start a Sole Proprietorship in Japan

Once you’ve decided on your business’s name and address, head to the National Tax Agency website to download the Sole Proprietorship Application Form (個人事業の開業届出 kojin jigyo no kaigyo todokede).

While the form is pretty simple, it’s all in Japanese. If you’re not confident, read on for a step by step guide! You should fill out the form in Japanese too, so have your details on-hand and ready to copy from.

As many facets of the Japanese government are somewhat old-fashioned, it’s probably easiest to fill in the form on your computer, print it out, and send it via post.

How to Fill in the Sole Proprietorship Application Form

- Circle or highlight 開業, which indicates you intend to start a business (as opposed to 廃業, which would be if you were closing your business).

- Write the name of your tax office. You can search for it by entering your business’s address here. Underneath, insert the date you’ll submit the form.

- Write your business address and phone number. If it’s your home address, select 住所地, if it’s an office or shop, select 事務所等. If you do not currently reside in Japan but your business will take place in Japan, select 居所地.

- Box 4 will only need to be filled out if any of the following apply: For tax purposes, your business address will be your home, however, your actual business will be conducted elsewhere. Write this second business location in Box 4 and your home address in Box 3. Additionally, if your business will be at an office for tax purposes, not your home, write this office location in Box 3 and your home address in Box 4.

- Here you’ll enter your personal details, including your name, birthdate, your “My Number” (個人番号), occupation, and your sole proprietorship trade name. You can just put 会社員 or something similar for occupation. After printing out the form, stamp your hanko here if you have one.

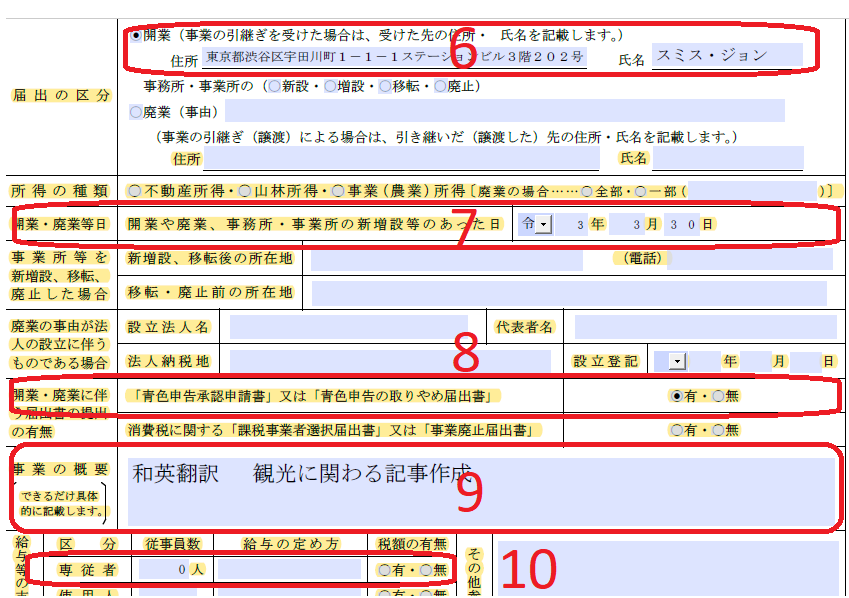

- Select 開業 and re-enter your name and address. You can ignore the rest.

- Enter the date your business started. You can either enter the date you’re filling out the form or the date you actually started work, but don’t make it more than a month old. The next two sections can be skipped as they only apply to those whose business expanded, moved, or closed.

- Here you can select whether you’ll be sending additional documents along with your application. Generally, you’ll want to select 有 to send the 青色申告, an application for the Blue Tax Return scheme that has numerous benefits (see below).

- Here you’ll provide a brief overview of your business in Japanese. For example, if you’re opening a translation business, write something like 和英翻訳 with some additional details.

- Box 10 is to write the number of employees you have. If it’s just you, write 0 and don’t worry about the rest of the form.

Don’t Forget Valid ID!

You’ll need to send a copy of your My Number Card for authorities to confirm your identity.

If you do not possess a My Number Card, send a copy of your Tsuchi Card (通知カード) or Juminhyo (住民票) displaying your Personal Identification Number (個人番号) (not all of them possess this, so you’ll need to double check), along with a copy of one of the following:

- Driver’s License

- Passport

- Zairyu Card (在留カード)

Tax Requirements For a Sole Proprietor

As your business is not a separate entity, you’ll be personally responsible for several taxes, including income tax, sole proprietor tax, and residential tax. The individual income tax year runs from 1 January to 31 December and taxes must be filed before March 15 the following year.

When filing your income taxes, there are two types of forms to choose from: White or Blue. If you do not apply for the Blue Tax Return, you’ll be automatically defaulted to the White.

While a little complicated, a Blue Tax Return (青色申告) has several benefits, most notably the ability to make deductions against your income tax. This includes a deduction of up to 650,000 yen if you keep double entry records and attach your income statement and the balance together with your next tax return. For this reason, we recommend applying for the Blue Tax Return together with your Sole Proprietorship Application Form.

Applying For the Blue Tax Return

The application form for the Blue Tax Return can be found here.

The first two boxes are almost identical to the Sole Proprietorship Application Form, so you shouldn’t have any trouble filling these out.

The next part contains 6 sections. Before starting, write the current financial year above (as per the Japanese imperial calendar):

- If your business has multiple locations, write them here. If you only have one, you can leave this blank.

- Check 事業所得 (business earnings).

- If you have applied for the Blue Tax Return before, check 有 and then select 取消し if you were rejected or 取りやめ if you withdrew, and write the date it occurred. If it’s your first time, check 無.

- If you started your business after 16 January of the current year, write the founding date. If you started your business earlier, leave it blank.

- If you inherited the business, write the date of inheritance. Select 無 if not.

- For a 650,000 yen deduction, check 複式簿記 (double-entry bookkeeping). For a 100,000 yen deduction, check 簡易簿記 (simple bookkeeping).

- To opt for a 650,000 yen deduction, check 現金出納帳・売掛帳・買掛帳・経費帳・固定資産台帳・預金出納帳・総勘定元帳 and 仕訳帳. For a 100,000 yen deduction, check 現金出納帳.

To apply for the 650,000 deduction, you’ll need to keep meticulous records of receipts, expenditure, accounts receivable, accounts payable, fixed assets, deposits, settlements, and other forms of bookkeeping. If you don’t know what these are, thorough research on a tax information website is absolutely necessary. If you plan on making large deductions, it’s best to consult a tax agent before filing.

You’ll need to submit the Blue Tax Return Application Form within 2 months of starting your business, which is why it’s easier to apply for both at the same time.

Sending Your Forms

Once you’ve double checked everything, purchase a Japanese-style envelope and stamp and collect, neatly fold, and place the following inside:

- The Sole Proprietorship Application Form (個人事業の開業・廃業等届出書)

- 1 additional (控用) copy of the Sole Proprietorship Application Form (this additional copy will fill itself out automatically on the PDF version)

- My Number Card copy or copies of other ID

- An additional envelope with a stamp and your name/address for the tax office to send back to you

Afterwards, write the following on the front of the main envelope in Japanese tategaki vertical writing:

- The address of your tax office

- The name of your tax office as follows: (name of the tax office) + 税務署 御中 (eg. 渋谷税務署 御中)

- The name of the form in RED PEN as follows: 個人事業の開業届出 在中

Once your envelope is sealed, place it in the mailbox and you’re done! If you don’t want to send it, you can drop it off directly at the tax office, either by bringing all the documents and ID during office hours, or by placing your sealed envelope in the office drop box any time of day or night.

Wrapping Up

By following this guide, you’ve taken several giant leaps towards self-made success in Japan! Of course, for specific financial, tax, and business advice, always consult a qualified adviser. We wish you the best in your Japan ventures!

The information in this article is accurate at the time of publication.