Should I Invest While Living in Japan?

In General, Investing is a Good Idea.

With interest rates near zero, any money you don’t expect to spend within the next couple of months is slowly losing its value over time. Due to inflation, purchasing power is almost always increasing meaning that 100 yen today is 95 yen next year. Because of this, your money is worth the most the day you earn it, and every day you let it sit and collect dust, the lower and lower its value gets.

This is the basic impetus behind investing, the idea that un-invested money loses value over time despite the future growth of the economy. After you’ve saved a healthy emergency fund, putting the money you don’t expect to need within the next six months or so into investments is the best way to make sure your wealth keeps up with the economy.

While you may be fine living on your income and spending within your means for now, you won’t always have a job. Come retirement, having access to a large nest egg nurtured through careful investing is not only desirable (who wants to work when they’re 60 or 70?) but completely achievable.

But What About Foreigners Living in Japan?

The great thing about this advice is that it’s not only applicable in your home country, but in Japan as well! Any resident of Japan (citizen or not) can invest in the Japanese or foreign stock markets and put their hard-earned yen to good use.

However, everyone’s situation is different. Various countries have different tax regulations for their citizens (even if citizens living abroad) that may make it less or more advantageous to invest while in Japan. You should be sure to look up your country’s regulations and make the proper calculations before deciding to invest your money here or in an account back home (assuming that is an option).

While we can’t speak to everyone’s situation, we can at least provide an overview of investment services in Japan that anyone can use should they choose to do so!

Investing in Japan Basics: Two Types of Investment Accounts

When creating an investment account, you’ll generally be given the option between two types of accounts: tax-advantaged (非課税口座), and non-tax-advantaged (課税口座).

Tax-advantaged accounts, such as NISA (Nippon Individual Savings Account) or iDeco (Japanese private pension plan) are designed to help people invest for retirement. These types of accounts will have monthly/yearly contribution limits, and in exchange, will be exempt from taxes that are usually applied to capital gains for a certain period of time.

Non-tax-advantaged accounts, which cover most other investment accounts, are designed for regular investing and are taxed at normal rates. You can invest as much money as you want in these, though you will have to factor taxes into any gains you expect to make. Since our other article covers NISA, this article is going to cover non-tax-advantaged accounts.

Non-Tax-Advantaged Accounts: Two Different Styles of Investing

For most people who invest in Japan, there is a choice between two styles of brokerage accounts: directed style and self-directed style. There’s no limit to the number of accounts you can have, so you could choose to create and use only one, or you could go ahead and use both. It all depends on your own investment strategy and plan.

Directed Accounts: Roboadvisors

・Advantages of Directed Accounts

Directed accounts are usually run by “roboadvisors.” These roboadvisors, created by the brokerage, use an algorithm to search the market and create a stock portfolio unique to you. It’ll keep track of the investments it has chosen, selling off bad stocks while acquiring new ones, all the while trying to keep your portfolio growing at an acceptable rate. All you need to do on your end is feed it the funds to invest.

Set up recurring payments into the account for a truly automated investing experience and create a nest egg with as little hassle as possible. Check in occasionally to see how your investments have grown, or to change the strategy of your roboadvisor to riskier (more aggressive) investments or less risky (more conservative) investments.

These sorts of accounts are perfect for the investor who wants to see their nest egg grow but doesn’t have the time to learn the stock market or the financial knowledge necessary to create their own portfolio. Where normally you’d need to dedicate some time each month or year to reassessing your positions, balancing your portfolio, and doing research into companies, the roboadvisor takes care of all of that for you, saving you time while also growing your wealth.

・Disadvantages of Directed Accounts

There are some downsides to going with roboadvisors, however. Besides the fact that you can’t individually choose your investments and thus lose out on the ability to create and customize your portfolio, you also have to factor in cost. Directed brokerages in Japan routinely charge yearly fees to the tune of about 1% of assets under management, which is all the money in your investment account.

Now, 1% may not seem like a lot, but this sort of fee eats into your returns very quickly. If your account has an expected growth rate of 6%, which is a decent average for a balanced portfolio, it’s only 5% when the fee is calculated in. This can severely affect your returns over the long run.

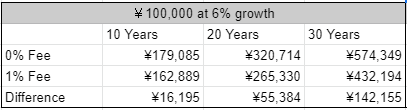

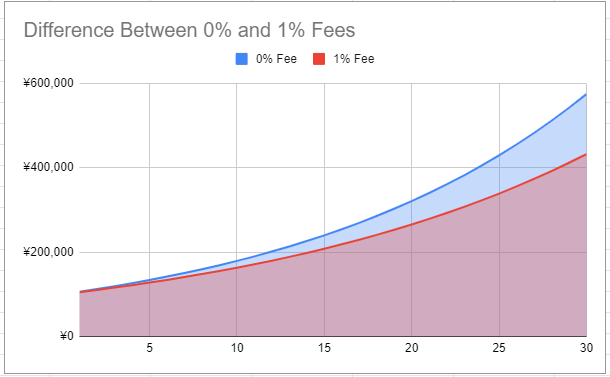

For example, say you invested 100,000 yen today into each type of account: one self-directed account with 0% fees, and one roboadvisor with 1% fees. This is how your investments would stack up over the course of 30 years with a 6% growth rate:

After 10 years, that 1% fee has cost you 16,195 yen; a none-too insignificant amount. At 20 years, you’ll have lost 55,384 yen, and by 30 years, you’re out 142,155 yen—more even than your original investment! This is, of course, just the fee for the roboadvisor and doesn’t take into account other fees that the company will charge when buying you stocks/funds, which will also compound on that initial 1% fee.

Before choosing a directed account, consider how much your money is worth to you, and how much you’re willing to part with in order to grow your nest egg hassle-free.

Self-Directed Accounts

Self-directed accounts are run by you! When you open a self-directed account with a brokerage, you send money over from your bank account and then call all the shots yourself. You research stocks, ETFs, mutual funds, and bonds; choose how many of each you want to buy and at what price; and decide when to sell them, how long to hold onto them, and everything else. It’s all up to you.

This account is of course most suited for experienced investors, as they’ll have an idea of what kind of portfolio and strategy they want to build. For the novice, it might be a bit more intimidating, but with a little bit of research and study, those hurdles are easily overcome.

With self-directed accounts, both the pros and the cons stem from the fact that you’re ultimately responsible for everything to do with your investments. With the ability to customize and build your own positions, you can easily outcompete the roboadvisors who trade on potential safe and low-risk algorithms. Similarly, if you find your investment decisions were unwise, all the fault lies with you. In exchange for this freedom, you don’t have to deal with the fees of paying the company to run the roboadvisor, and instead will just pay commissions on trades. These commissions, however, are flat and are on a per-trade basis, meaning that although they add up over time, they don’t compound like a percentage fee does. A little bit of effort equals a lot more money in your pocket!

Recommended Brokerages

There’s plenty of choice to be had for brokerages in Japan! Here we’ll list the best we’ve come across for both directed and self-directed accounts. A note of caution, however: English language support (outside of the sole exception at the bottom of the list) is nonexistent. All these brokerages operate in Japanese, both in their registration applications as well as their web and app interfaces.

If your Japanese isn’t up to par with financial terms (a feat sometimes difficult for natives as well!), expect to make good use of online translation services or a Japanese friend in order to interact with your account. This can be an annoyance, for sure, but not an insurmountable hurdle, and definitely worth it considering the benefits of investing your idle yen.

Directed Brokerages

Founded in 2015, Wealthnavi is one of Japan’s most popular directed brokerages. Their roboadvisor, like all others, works on various algorithms to build a portfolio for you.

Upon opening an account, you can take a quick 6-question survey that will determine your risk profile. From there, the roboadvisor will build you a portfolio that matches your desired risk and return. After the creation of the managed portfolio, you can set up automatic funding, with transfers from your bank account on a monthly, semi-annual, or annual basis to be automatically invested by the roboadvisor.

Every 6 months, the roboadvisor will also rebalance your portfolio automatically to make sure you’re in line with your goals. You can also access your account and add funds through their smartphone app, which makes the process as easy as possible.

Fees and information:

- Annual rate: 1%

- Minimum investment: 100,000 yen

- Free services: Deposits, withdrawals, and trading fees.

- Primarily app-based

- https://www.wealthnavi.com/

Theo – Cheaper Fee With Increased Investment

Theo, which touts the superior AI of their roboadvisor, primarily invests in ETFs. These ETFs, or Exchange Traded Funds, are bundles of stocks that are used for diversification purposes so you don’t end up putting all of your eggs in one basket. Theo will choose from 30 ETFs to build a balanced portfolio for you, which in total consist of 11,000 stocks from 86 different countries. Historically, the roboadvisor has been able to get a return of roughly 8% per year. Like Wealthnavi, Theo also rebalances your positions and optimizes for minimal taxes, and has a good smartphone app.

Fees and information:

- Graduated fee structure depending on deposited money

- ¥10,000-500,000 = 1%

- ¥500,000-1 million = 0.8%

- ¥1 million to 10 million = 0.7%

- ¥10 million plus = 0.65%

- Minimum deposit: 100,000 yen

- Web and app-based services

- https://theo.blue/

Raku Wrap – Choose Your Fee Structure

Rakuten’s roboadvisor Raku Wrap started in July of 2016 and operates on a similar basis to other roboadvisors. You add funds to your Raku Wrap account, and after answering a quick questionnaire, the advisor will ask you to choose from 9 different possible portfolios. Unique to Raku Wrap, the roboadvisor has built-in risk protection from volatile markets. When prices in the market begin to make large swings, the roboadvisor will automatically invest part of your savings into bonds, which are safer and less risky than other securities.

Fees and information:

- 2 different fee structures: fixed or performance-based

- Fixed: 0.715% + 0.270% management fee

- Performance based: 0.605% + 5.5% performance fee + 0.270% management fee

- Web and app-based services

- https://wrap.rakuten-sec.co.jp/

Self-Directed Brokerages

Kabu – Apply in Less Than a Minute

Kabu, a division of the popular phone company AU, allows for a painless setup process that can be done in under a minute on your phone. Simply take pictures of the required documents in “selfie mode,” wait for your account approval, then login to the web interface and transfer over your funds to begin trading! Kabu is a fully-fledged broker and offers a large suite of securities for investment, including some zero-fee ETFs.

Fees and information:

- Fees on a per-trade basis

- ¥100,000 or less: ¥99

- ¥100-200,000: ¥198

- ¥200-500,000: ¥275

- ¥500,000+ : Price*0.099% + ¥99

- Free services: Account opening and management; most transfers; some withdrawals

- Web and app-based services

- https://kabu.com/

PayPay – Mobile Payment Account Integration

PayPay is a mobile payment service that has its own investment division. If you have an account with PayPay (which anyone in Japan can get) you can easily sign up for their brokerage. Once open, you will be able to trade across several different apps in their app ecosystem, which are tailored toward different products, such as Japan-U.S. Stocks, a Roboadvisor, IPOs, and more.

Fees and information:

- Fees on a per-trade basis

- Domestic/foreign securities during operating hours: 0.5% of base security price

- Transfers from banks: Mizuho ¥110, others ¥275

- Withdrawals to banks: Mizuho ¥220, others ¥385

- Free services: Account management

- Multiple apps for different products, web interface as well

- https://www.paypay-sec.co.jp/

Rakuten Securities – Free Transfers from Partnered Banks

Rakuten serves as another easy way to trade stocks in Japan. After applying on their website, your application will be reviewed and within a day or two, you will be able to start trading. You can transfer funds from Rakuten Bank, partnered internet banking services, and even ATMs. From there, you can trade a whole host of securities, both domestic and foreign, from their website or phone app. This is a good option for those who already have a Rakuten Bank account.

Fees and information:

- Fees on a per-trade basis

- ¥50,000 or less: ¥55

- ¥50-100,000: ¥99

- ¥100-200,000: ¥115

- ¥200-500,000: ¥275

- ¥500-1 million: ¥535

- ¥1-1.5 million: ¥640

- ¥1.5-30 million: ¥1013

- ¥30 million+ : ¥1070

- Web and app-based services

- https://www.rakuten-sec.co.jp/

SBI Securities – Wide Variety of Foreign and Domestic Stocks

One of the most popular and trusted stockbrokers in Japan, SBI is another good choice. Although their website is a little less modern compared to some of the other sites above, you can still deposit cash and trade easily enough, or use the smartphone app. With a large variety of accounts offered, along with many different investments to trade including U.S., Chinese, Korean, and other foreign stocks—or its own Roboadvisor—SBI is the last stop for an all-in-one solution to your investment needs.

Fees and information:

- Fees taken out on a per-trade basis

- ¥50,000 or less: ¥55

- ¥50-100,000: ¥99

- ¥100-200,000: ¥115

- ¥200-500,000: ¥275

- ¥500-1 million: ¥535

- ¥1-1.5 million: ¥640

- ¥1.5-30 million: ¥1013

- ¥30 million+ : ¥1070

- Primarily web-based service, app as well

- https://www.sbisec.co.jp/ETGate

Matsui Securities – Free Trades at 500,000 yen or Less

For Matsui securities, you can open your account through their website or by mail. When doing so, you will select what kind of account you want to open and what privileges you want to be associated with it such as basic stock trading only, or more advanced margins and forex trading. Once you’re approved, trading is all done through their website. Notably, transfers from banks online are both instant and free, which is a step up over some of their competitors. They also offer free trades every day up to 500,000 yen, so low volume traders can save a lot.

Fees and information:

- Fees on a per-trade basis

- ¥500,000 or less spent per day: ¥0 per trade

- ¥500-1 million spent per day: ¥1100 per trade

- ¥1 million-2 million spent per day: ¥2200 per trade

- Each additional million spent adds ¥1100 to the previous tier, with an upper limit of ¥110,000

- Web and app-based services

- https://www.matsui.co.jp/

Interactive Brokers – English Language Support

Interactive Brokers is a global brokerage with branches in many different countries across the world, including Japan. While each company is a separate entity, they all more or less conform to the same style and available securities. Besides having a modern, slick interface, with both browser and app trading available, what makes Interactive Brokers stand out is the fact that they offer English language support. Specifically for U.S. citizens, who have to worry about paying U.S. taxes on their foreign investments, Interactive Brokers is a good choice, as the company is U.S.-based and familiar with all tax requirements.

Of the options above, for those who are the least comfortable trading in Japanese, Interactive Brokers is the best option.

Fees and information:

- Requires initial deposit of ¥1 million to open an account

- Fees on a per-trade basis

- 0.08% of trade value, with a minimum of ¥80 and no maximum fee

- Web and app-based services

- https://www.interactivebrokers.co.jp/en/index.php?f=47661&p=english

Get Out There and Invest!

There’s no reason to leave your money sitting in your bank account, collecting dust and depreciating in value. With the added benefits of smartphone apps and roboadvisors, it’s never been easier to invest while living in Japan. Choose any of the above brokers, and you too can watch your savings blossom in tandem with the economy!

Title image: New Africa / Shutterstock

Thông tin trong bài viết được cập nhật tại thời điểm công bố